A Beginner’s Guide to Financial Planning

From the outside looking in, financial planning can be an extremely daunting concept to tackle. It’s not uncommon for those of us without any formal financial education to feel like having a strong personal financial plan just isn’t in the cards for us. Unfortunately, none of us get to opt out of participating in the financial world. Whether you like it or not, your personal financial health is one of the main determinants of how your future is going to unfold. The opportunities you can afford to take, your physical health and your overall quality of life are all directly linked to how you manage your money.

So, where does an amateur begin? In order to take control of your financial future, you do need to start planning; there’s no way around this. Without a clear plan for your money, you inevitably won’t be able to stay afloat when unforeseen challenges come your way (not to mention retire at a reasonable age). However, your entry into the world of financial planning doesn’t have to be complicated to be effective. By following a few simple rules, you’ll be able to reassess the way you manage your money without having to get a Masters in Finance.

Tracking Your Expenses

Maintaining a strong budget is, admittedly, very hard. It takes having an in-depth knowledge of your own financial situation, the ability to plan semi-accurately about what you’ll need money for and the willpower to live within the boundaries you’ve set for yourself. People often dive in with budgeting, only to find they can’t stay on track and scrap the whole thing. With this in mind, be sure you’ve fulfilled the first requirement of successful budgeting before moving forward; you need to understand, in detail, where your money is coming from and where it’s going. You can’t skip this step and expect to succeed!

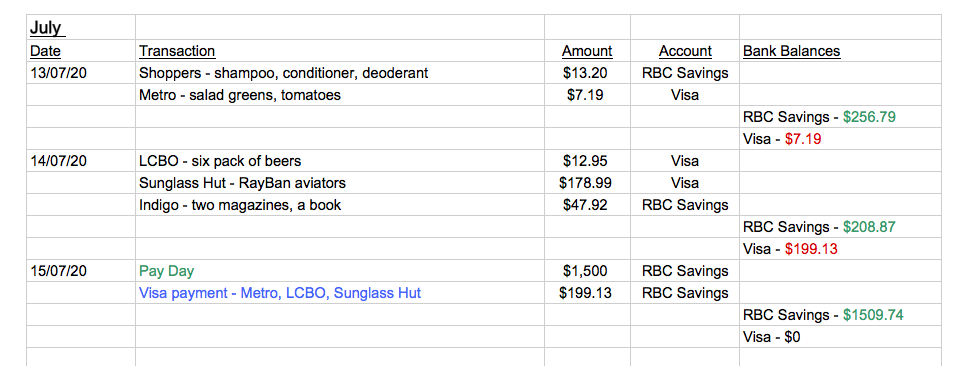

A great place to start is to simply create a spreadsheet to track your expenses. It’s really tough to understand what kind of budgetary limits you should set for yourself if you don’t have a clear idea of how much money you’re spending and where. But, once you’re into the habit of monitoring your expenses, you’ll know where you can make changes to your spending habits and have the data to prove it.

Start your spreadsheet and organize it by month. Include the date, your transaction history (credits and purchases), the amount of each transaction, which account each transaction came in/out of (ex. credit card, savings), and the balance of your bank account/s at the end of each day. You can categorize your transactions by colour if that helps you establish your spending patterns. Make sure you’re updating the document every few days and checking your bank balance/s regularly to ensure that the two match up. Though you can customize your tracker to look how you’d like, here’s an example:

Learn to check your bank balance and update your expenses tracker regularly so that you know where every dollar is going. If you’re the type of person that avoids checking their balance because of fear, stop! That number isn’t going to change for the better, but it could easily get worse if you’ve put yourself in a position to accrue NSF bank fees without realizing it. You need to know, on any given day, how much you owe in debt (on credit cards or otherwise), how much money you’re taking in and how much you have in savings.

The old saying is absolutely true: knowledge is power. Many people find they don’t even need to set a formal budget for themselves if they stay up to date with tracking their expenses. If you know exactly where you money is, you can adjust course quickly to stay within your means. By consistently tracking your expenses, you’re ensuring that you’re well-informed about your overall financial health and better able to manage any setbacks that may come your way.

Set SMART Goals

Once you’ve mapped out your current financial situation, you can start to create a meaningful plan for your money by setting goals for yourself. This step deserves some careful thought, but your first goal can be anything: a down payment on a home, your child’s braces or a post-COVID dream vacation. This goal is going to be your motivation to stay on track, and what you train yourself to think of before making impulsive purchases. If you don’t actually care about getting there, staying on track with your spending is going to be nearly impossible.

The basic framework for setting an effective goal is called the SMART goal. Though it seems straightforward, don’t underestimate how powerful it can be. This concept is taught in business schools and project management courses across the country because it’s proven time-and-time again to be extremely effective. It follows as such:

S – specific

Your goal needs to be specific so that there are clear parameters for you to follow. For example, saying “I will save money” and saying “I will save $25” are very different. The former leaves an ambiguous question of how much money to save, whereas the latter sets a clear objective.

M – measurable

You need to be able to measure your results in order to know if you’re on track to achieve your goal. For example, resolving to save your $25 in your bank account (so you can clearly see a balance of $25) means you’ll have concrete evidence that you’ve reached your goal.

A – attainable

Your goal needs to be something you can attain given the resources, talents and time you have now. For example, saying “I will save $25 by walking everywhere I need to go” only makes sense if you live in a busy metropolitan area. If you need to drive to get to work in a timely manner, walking everywhere to save money on gas is not an attainable way to achieve your goal.

R – realistic

Your goal needs to be something that you can actually achieve, barring any kind of miraculous event. For example, pledging to save $1 billion dollars is not something the average person can feasibly reach in their lifetime. On the other hand, pledging to save $25 should be no problem.

T – time-bound

Goals mean nothing without some kind of time-based structure to ground them. For example, by saying, “I will save $25”, you’re establishing a specific goal but leaving it open-ended. By saying, “I will save $25 by August 7th”, you set a deadline for when that $25 needs to be in your account. Having a timeline will keep you accountable, and will be crucial when breaking down large goals into smaller, easier to handle steps.

From our above example, our SMART goal could be

“I will save $25 in my bank account by reducing my spending on coffee by August 7th.” This goal gives you a specific, measurable, attainable, realistic and time-bound outline of how you’re going to save $25, and eliminates the ambiguous wiggle room that we often allow ourselves when facing challenges, causing us to fall off track. As you begin to set goals, ask yourself, “is this SMART?”. Write out the acronym on a piece of paper or a post-it note to keep as a reference and think about your goal. Does it work within the SMART framework?

Be sure to assess your progress along the way when working towards any goal. Check in with yourself every week or two and note what you’ve done to accomplish the goal, what still needs doing and how you’re going to do it. That way, you can confirm that you’re on track to meet your goal by your deadline and adjust course when necessary.

Short Term v. Long Term Goals

Now that you know how to set a SMART goal, it’s important to think in more depth on that last letter: T, for time-bound. Every kind of goal you set for yourself will naturally have a basic time limit attached to it. For example, creating an emergency fund is seen as one of the best short-term financial goals to have, and is something we strongly recommend to all QUBER users. It won’t necessarily be easy, but it shouldn’t take you three years to accomplish. Retirement, on the other hand, is most people’s longest-term saving goal, and is one that can’t be achieved in one year without a winning lottery ticket.

In general, you need to concern yourself with achieving your short-term goals before tackling the big ones, like retirement. Not to say your long-term goals are unimportant, but it's too much to dive in with such a massive objective as a beginner. There are also almost certainly other, more immediate financial concerns that will need your attention first. If you can meet your short-term goals successfully, you’ll not only have a bit of a financial buffer to help you navigate your future, but you’ll have gained the practical experience you need to successfully reach your long-term goals. Here are a few examples of common financial goals and their respective timelines:

Credit Card Debt v. Emergency Fund

This is a dilemma that even financial experts often disagree on; should you be putting money into your emergency fund if you have credit card debt to pay off? Chances are, you do have some debt to pay down if you’re just starting your journey with financial planning. Think about your current financial obligations; you’ll have to decide where the priority should lie depending on your own personal situation.

On one hand, having an emergency fund will help you prevent getting into more debt in the future, should such a situation arise. If 2020 has taught us anything, it’s to be prepared for the unexpected! However, many of us already recognize that racking up interest fees on your card as you spend is a slippery slope. If you have a high amount of debt, it probably makes sense to tackle that issue first before really investing in your emergency fund. Otherwise, you can expect that much of what you save will eventually be used to pay off that debt anyways. If you’re closer to a zero balance on your credit card or already have a clear plan to eliminate your debt, now is a great time to start saving small amounts of money on the side. You can start an emergency fund through your QUBER account easily by clicking here.

The above strategies are just the first steps you’ll need to take towards creating a thorough financial plan, but are incredibly important to master if you’re trying to get serious about it. Remember that progress is almost never linear, and you can be sure that you’ll hit some setbacks along your path to your major goals. As long as you’re not trending in that direction, you’re on your way! There are a huge number of resources that can help you manage your money, but only you can definitively change your financial habits for the better.

Check back to Money Talks every Monday for a new post featuring more tips and tricks on how to reach your saving goals.

Have a suggestion for something you’d like us to write about? Shoot us a message at contactus@quber.ca and we’ll get to work!