How to: Boost Employee Engagement & Retention

There are a number of challenges that all employers must face throughout the process of recruiting, onboarding and retaining their employees. Of these challenges, two of the most critical are those of employee engagement and employee retention. If you’re an employer, you’re probably constantly asking yourself, how can I keep my team focused on my organization’s goals and hold onto their professional loyalty for a long period of time? In order to answer this question effectively and craft your own strategic plan to promote employee engagement and retention, you’ll first need to ensure you understand why these metrics are so important while also recognizing what kind of factors cause these workplace metrics to decline.

Employee engagement can be described as a series of conditions that encourage an organization’s employees to “give their best each day”, meaning they feel connected to their organization’s goals and feel motivated to contribute excellent work to their team’s collective effort as often as possible. Data from 2019 collected by Statista shows that 66% of employers see employee engagement as the top key performance indicator (KPI) when determining the success of an employee onboarding program. The reasoning here is clear; employees who feel they have a vested interest in the overall success of their organization are more productive and create higher-quality work than employees who don’t feel the same sense of connection to their professional responsibilities.

Our other metric of focus, employee retention, is arguably even more important than employee engagement in the average organization. According to the same Statista data set mentioned above, employee retention is seen by 70% of employers as the most important KPI in terms of evaluating the success of an employee onboarding program. Organizations that struggle with employee retention waste thousands of dollars training employees who don’t stick around for long-term tenures, and numerous team members waste significant amounts of their own time and effort in the process of onboarding these new hires. This in turn reduces an organization’s overall productivity, as time spent training employees who don’t stick around is time taken away from other business objectives. Beyond just the waste of valuable resources, poor employee retention rates can create a troubling cycle if left unchecked. If an organization is constantly scrambling to fill their employee roster and then keep any new hires they find, that inevitably means that other staff members will be expected to pick up the slack until all the necessary positions are filled on a permanent basis. This kind of excessive addition to an employee’s workload can cause them to burnout and lose their sense of engagement with their job. This may push them to look for employment elsewhere or take advantage of other professional opportunities presented to them, further decreasing the organization’s employee retention rate and perpetuating the cycle.

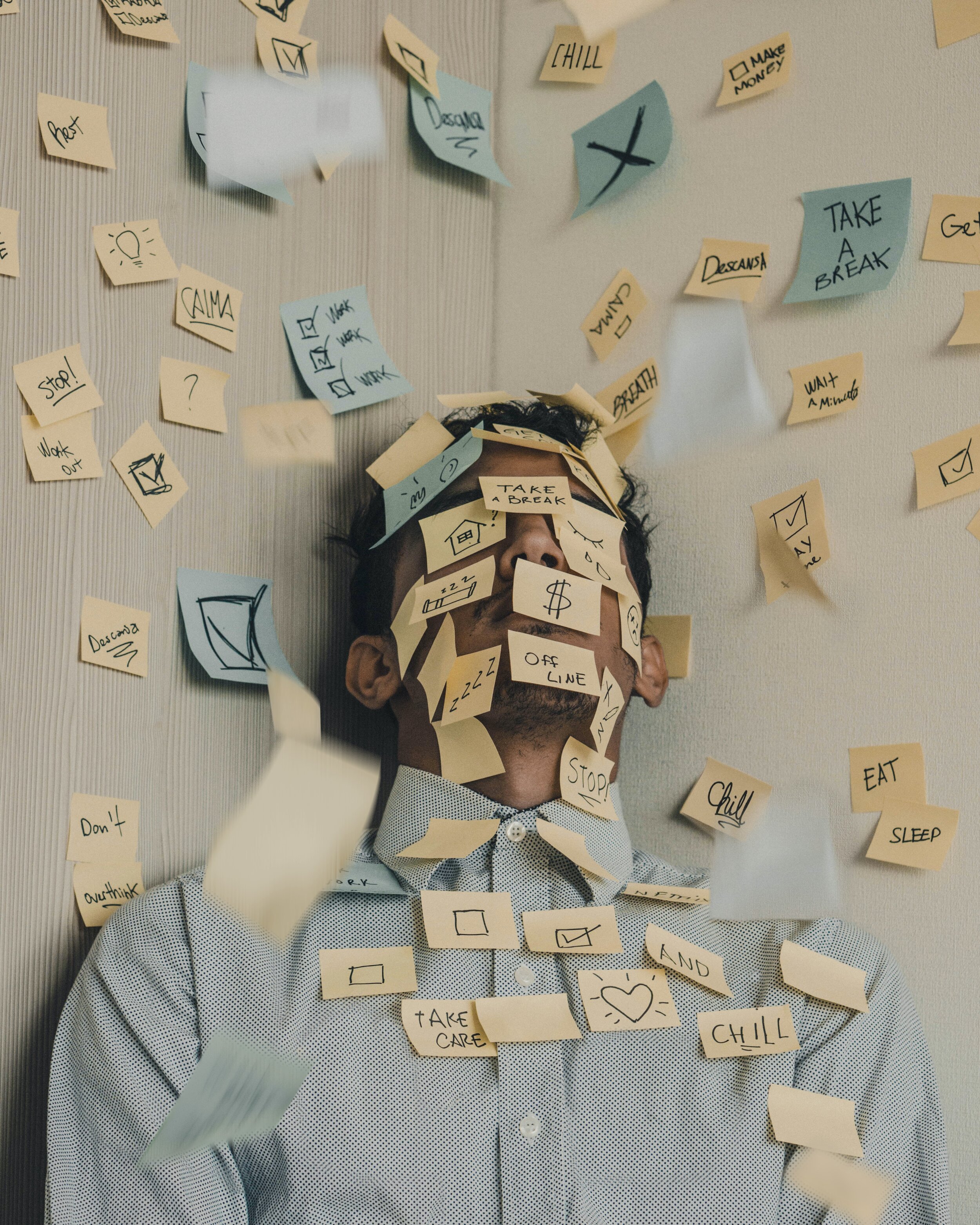

But, what is it that causes employee engagement and retention rates to decline in a workplace? Though it is a complex mix of factors that causes each problem, including ebbs and flows in a business’s success, workplace culture and economic volatility, there is a simple answer: stress. Employees who experience abnormal levels of stress in their lives are unable to focus their energy on their responsibilities at work the way their employers need them to. Stress can be amplified by numerous factors, such as personal matters like health and family issues, but is most often caused by an employee’s financial situation or their workload. Particularly in the volatile, pandemic-stricken world we’re living in today, stress is on the rise; 77% of employees have reported that their stress levels have increased over the past 12 months.

Of particular importance when discussing stress as a leading cause of poor employee engagement and retention rates is financial stress. Research from PwC shows that 46% of employees consider their personal finances to be the greatest cause of stress in their lives (this makes financial stress the leading cause of personal stress amongst all other types of stress, such as concern related to one’s workload or personal matters). An employee that is worried about how they’ll make their next rent payment or how they’ll cover a surprise medical bill is unable to be fully engaged in their workplace. A recent study published by MetLife showed that employees that are not on track with their personal financial goals are less likely to be satisfied with the job they have now, are less committed to their organization’s goals and are less likely to still be with the same organization in twelve months time. They are also less likely to be engaged and productive, and are more likely to be stressed out and tired. The effects of financial stress on an employee also have a tangible impact on their employer’s bottom line. A 2018 report from PwC estimates that financial stress costs an employer with 10,000 or more employees around $3.3 million a year in lost productivity due to absenteeism and a lack of focus in the workplace.

Financial stress has only been amplified with the onset of the global pandemic, as economic volatility has put thousands of Canadian households on uncertain financial ground. The same MetLife study mentioned above reported that 70% of employees who earn under $50,000 a year are more stressed as a result of the pandemic, and still 66% of those who earn between $50,000 and $100,000 a year are feeling more stressed since the onset of COVID-19. These stressors are even more greatly amplified for employees with school-aged children as we move towards the onset of the 2020/21 school year. On one hand, these employees need the child care provided by school to get back to work and deliver high-quality results for their organizations, but thousands of parents are feeling more stressed than ever with the thought of their children going to school and potentially bringing home COVID-19 after contracting it in the group environment of their classes.

With that in mind, a great strategy for employers to increase their employee engagement and retention rates is to help their employees minimize their stress levels. By praising their work and offering their employees extra support, employers can show their staff that they respect their contributions to the organization as a whole. Research shows that employees who feel valued within their organization are more likely to be productive, remain loyal to their employer and avoid getting burnt out. There are a few great ways that employers can put this strategy into action, such as ensuring that employees are assigned a manageable workload, allowing them some flexibility in their work schedule and giving them a reasonable amount of time to deal with their personal obligations. By trusting employees to deliver high-quality results, even if they do it on a slightly unorthodox schedule, employers can work towards building a strong sense of loyalty and confidence between themselves and their employees. Particularly now that work-from-home arrangements have employees struggling to define a clear divide between their personal and professional lives more than ever, giving your employees the opportunity to manage their various responsibilities as it works best for them is a great way for you to stand out amongst your competitors and foster a strong sense of loyalty with your team.

However, arguably the best way for employers to take action in reducing employee stress levels is to offer their staff members a financial benefits program. Financial benefits not only offer employees an increased level of income, but can help them manage their short-term financial needs more effectively so that they don’t have to dip into their long-term goals (ex. retirement savings) in order to make ends meet. This kind of extra support has the power to greatly reduce a concerned employee’s stress levels, meaning they can turn their focus towards their job. Beyond that, financial benefits programs can help teach employees strong, long-term saving habits, support them as they pay off long-standing debt and educate them on how to get excessive spending habits under control.

Beyond the fact that financial benefits can clearly reduce employee stress levels, they also offer employers an excellent opportunity to increase employee retention levels. According to MetLife, 80% of employees want access to financial wellness tools and/or financial planning programs but only 20% of employers actually offer these programs today. This gap between employee demand and employer supply is a major disparity, and is something that savvy employers should take note of. Offering financial benefits programs is a proven way to attract and retain talented employees, so if you find that you’ve been having trouble keeping your most capable staff members from leaving for new opportunities, offering a greater degree of financial support to your team may be an excellent solution to your problem. Particularly since the start of the pandemic, millions of Canadians have found themselves in a position of financial insecurity and are struggling to meet their short-term financial needs in ways they hadn’t before. Financial benefits are a great solution to this new problem, and can form stronger bonds between you and your staff.

If you’re an employer interested in adopting an innovative financial benefits package to retain your employees, reduce the effects of financial stress in the workplace and set yourself apart from your competitors, match-based saving benefits may be right for your business! QUBER is an industry leader in Canadian match-based savings and can offer Canadian employers a customized experience using the QUBER platform to facilitate match-based savings with their employees. If you’re interested in seeing a demo of how QUBER can help strengthen your relationship with your employees, send us an email at contactus@quber.ca or visit our Employers page and send us a message using the contact form found at the bottom of the page.

If you’re interested in receiving updates from our Employer Blog and more on financial benefits directly to your inbox,

click here to subscribe to our Employer Mailing List.